Managing personal finances is a crucial aspect of achieving financial stability and success. It involves planning, budgeting, saving, and investing wisely. By implementing effective strategies, individuals can take control of their financial situation and work towards their long-term goals. In this article, we will explore some key ways to manage personal finances effectively.

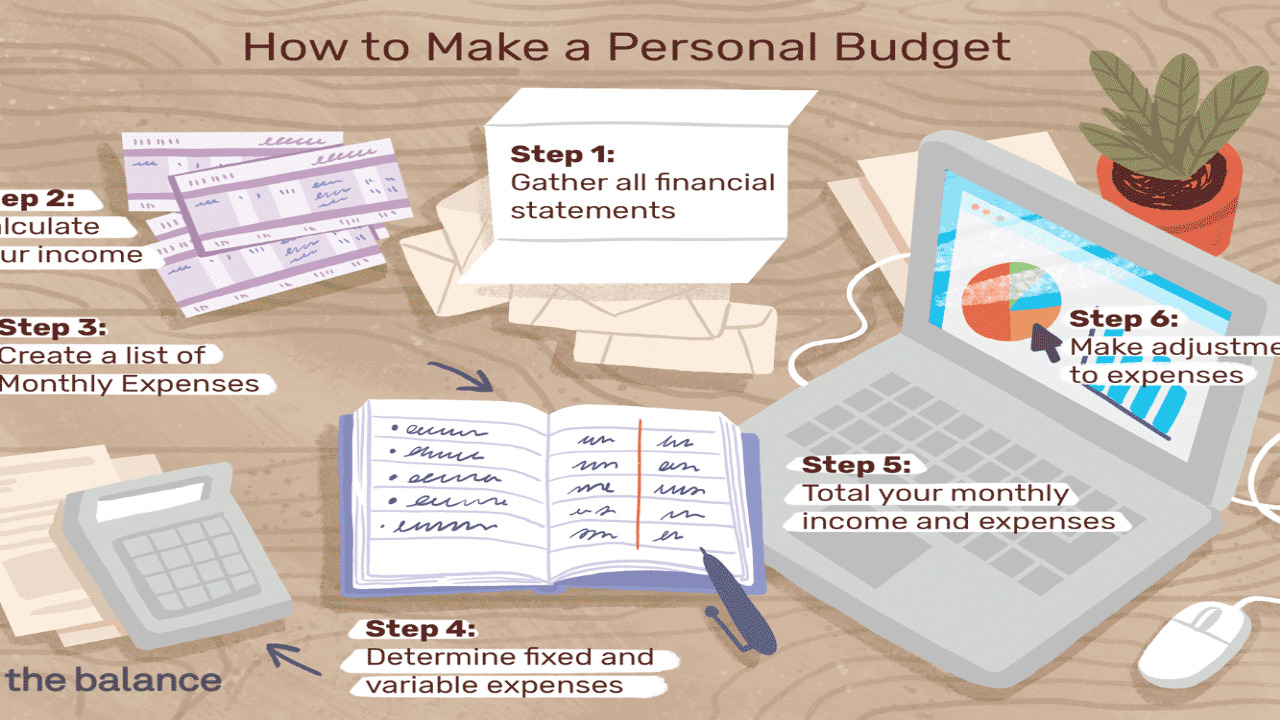

Create a Budget

One of the fundamental steps in managing personal finances is creating a budget. A budget helps track income, expenses, and savings. Start by listing all sources of income and then categorize your expenses, such as housing, transportation, groceries, entertainment, and debt payments. Allocate a realistic amount to each category and ensure that your expenses do not exceed your income. Regularly review and adjust your budget as needed to accommodate changes in your financial situation. If you want to review your salary or the salary of others, check PayStubCreator.

Track Your Expenses

To effectively manage your personal finances, it is crucial to track your expenses. Use tools like spreadsheets or mobile apps to record every expense you make. Analyzing your spending habits allows you to identify areas where you can make cuts and save money. By tracking your expenses, you hold yourself accountable and prevent unnecessary purchases.

Prioritize Saving

Saving money should be a top priority when managing personal finances. Aim to save a percentage of your income each month, ideally 20% or more. Establish an emergency fund to cover unexpected expenses, such as medical bills or car repairs. Additionally, save for long-term goals like retirement, buying a house, or starting a business. Consider automating your savings by setting up automatic transfers from your paycheck to a separate savings account.

Reduce Debt

Managing personal finances effectively involves reducing and managing debt. Create a debt repayment plan by prioritizing high-interest debts first. Make larger payments towards those debts while continuing to make minimum payments on others. Consider consolidating high-interest debts into a lower-interest loan, such as a personal loan or a balance transfer credit card. Avoid taking on new debt whenever possible and focus on paying off existing obligations.

Invest Wisely

Investing is an essential part of managing personal finances for long-term growth. Research different investment options and consider working with a financial advisor to determine the best investment strategy for your goals and risk tolerance. Diversify your investments to reduce risk and aim for a balance between low-risk and high-risk assets. Regularly review and adjust your investment portfolio to align with your changing financial situation and goals.

Set Financial Goals

Setting clear financial goals is crucial for effective personal finance management. Define short-term and long-term goals that are specific, measurable, achievable, relevant, and time-bound (SMART). Examples of financial goals include paying off a specific debt by a certain date, saving a specific amount for a down payment on a house, or achieving a target net worth within a specific timeframe. Setting goals helps you stay motivated and focused on your financial progress.

Seek Financial Education

To improve your personal finance management skills, seek financial education. Attend seminars, workshops, or webinars related to personal finance. Read books or online resources written by reputable financial experts. Educate yourself about various financial concepts, such as budgeting, investing, and taxes. The more knowledge you have, the better equipped you will be to make informed financial decisions.

In conclusion, effective personal finance management is crucial for achieving financial stability and success. By creating a budget, tracking expenses, prioritizing saving, reducing debt, investing wisely, setting financial goals, and seeking financial education, individuals can take control of their finances and work towards a secure financial future. Remember, managing personal finances requires discipline, consistency, and the willingness to adapt to changing circumstances.